jersey city property tax rates

2021 Table of Equalized Valuations for all of New Jersey. New Jersey Property Tax Rent Deduction.

New Jersey Sales Tax Small Business Guide Truic

I fully expect our local property tax rate to hit 21 - 22 percent within five years.

. Jersey City establishes tax levies all within the states statutory rules. Which are a function of property values and property tax rates. Tax Rates for Jersey City NJ Sales Taxes.

If you own your residence 100 of your paid property tax may be deducted up to 10000. The Tax Collectors office is open 830 am. Online Inquiry Payment.

Before the official 2022 New Jersey income tax rates are released. The tax rate is set and certified by the Hudson County Board of Taxation. Get driving directions to this office.

Jersey City New Jersey 07302. 217500 median tax paid. The median property tax in Hudson County New Jersey is 6426 per year for a home worth the median value of 383900.

Table of Equalized Valuations. COVID-19 is still active. Ad One Simple Search Gets You a Comprehensive Jersey City Property Report.

New Jersey Tax Court on January 31 2022 for use in Tax Year 2022. The County Tax Board certified the JerseyCity tax rate today with the final rate of 148 per 100 of assessed value previous estimated rate of 162 was in letters to residents so we came in below. Income Taxes.

TAXES BILL 000 000 50000 0 000 2034 4. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Tax amount varies by county.

700 The total of all sales taxes for an area including state county and local taxes. Stay up to date on vaccine information. 897 The total of all income taxes for an area including state county and local taxes.

The average effective property tax rate in New Jersey is 240 which is significantly higher than the national average of 119. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. City of Jersey City PO.

11 rows City of Jersey City. 252 551721 252 05 252 51 252. The average effective property tax rate in New Jersey is 242 compared with a national average of 107.

Each business day By Mail - Check or money order to. JERSEY CITY NJ 07302 Deductions. Assessed value 150000 x general tax rate03758 tax bill 5637 Jersey citys 148 property tax rate remains a bargain at.

Call NJPIES Call Center. Jersey Citys 148 property tax rate remains a bargain at least in the Garden State. Median Property Tax Rates By State.

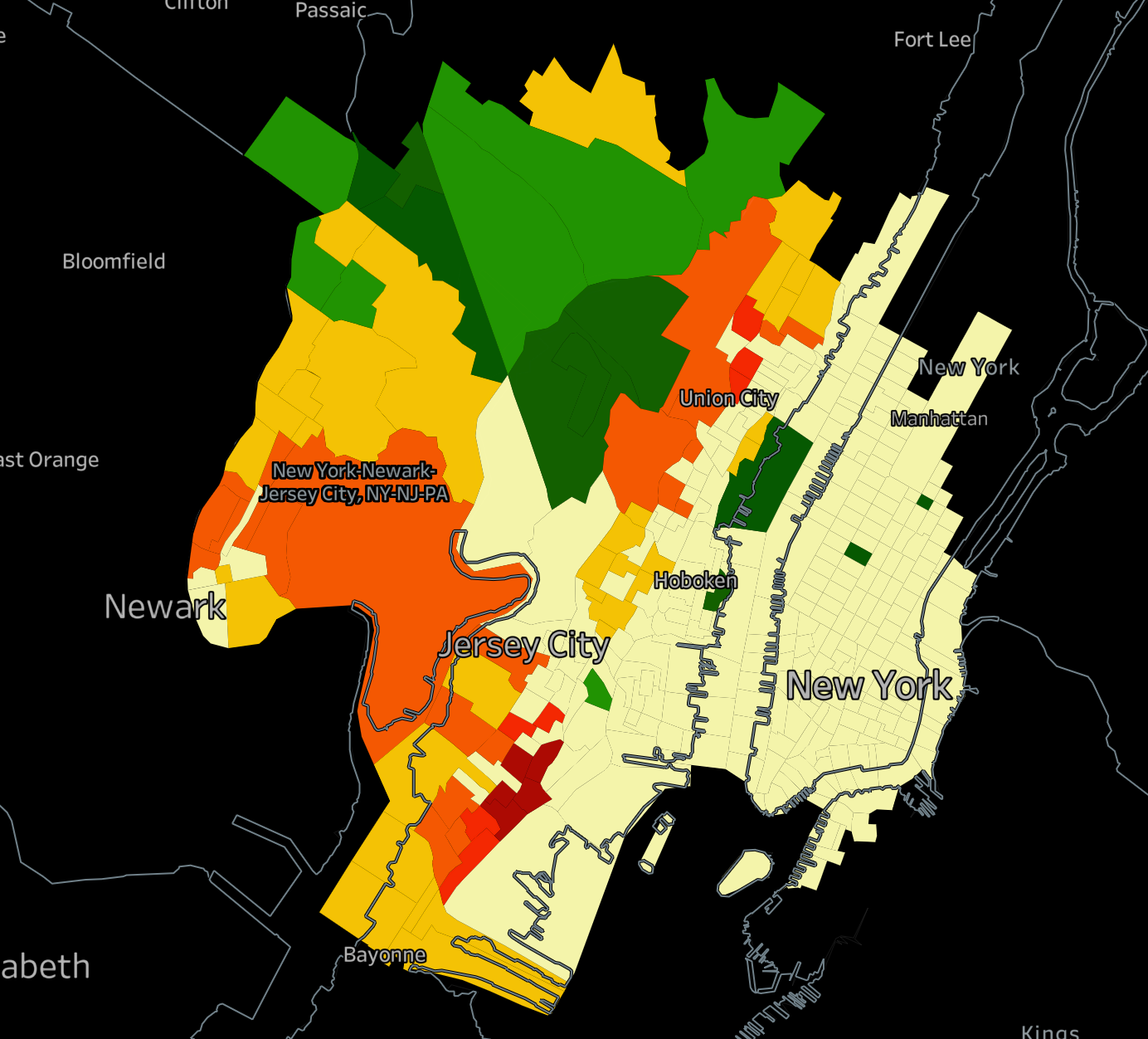

Property Tax Rate. 587 rows Click here for a map with more tax rates. Local governments like cities and counties are not allowed to charge local sales taxes on top of the new jersey sales tax so the rate applicable to all localities in new jersey is 6.

The General Tax Rate is used to calculate the. NJ Division of Taxation - County Equalization Tables. Enter City and State or Zip Code.

6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 8821 252 8821 35. Hudson County has one of the highest median property taxes in the United States and is ranked 14th of the 3143 counties in order of median property taxes. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements.

Certified October 1 2021 for use in Tax Year 2022 As amended by the. PROPERTY TAX DUE DATES. Ranked highest to lowest by median property tax as percentage of home value 1 1 New Jersey.

Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. The average 2020 New Jersey property tax bill was 8893 an increase of 157 vs. Property Tax Rate Published -- 148.

New Jersey has a special tax program that allows all residents to deduct as much as 100 of their property tax burden from their taxable income. Box 2025 Jersey City NJ 07303 Checking Account Debit. Property Tax Rates Average Residential Tax Bill for Each New Jersey Town The average 2020 Hudson County property tax bill was 8353 an increase of 159 from 2019.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. Hudson County collects on average 167 of a propertys assessed fair market value as property tax. 201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey.

Dont let the high property taxes scare you away from buying a home in New Jersey. New Jerseys highest-in-the-nation average property tax bill hit 9112 last year. This is the 5th year we have kept the municipal tax rate stable.

Real estate evaluations are undertaken by the county. When combined with relatively high statewide property values the average property tax payment in New Jersey is over 8400. Find Records For Any City In Any State By Visiting Our Official Website Today.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

New Jersey Is 2021 S State With The 7th Highest Tax Burden Study Scotch Plains Fanwood Nj News Tapinto

States With The Highest And Lowest Property Taxes Property Tax States Tax

Gov Murphy Unveils Anchor Property Tax Relief Program Whyy

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

The Jersey City Real Estate Market Stats Trends For 2022

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Delaware Property Tax Calculator Smartasset

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

New Jersey Real Estate Market Prices Trends Forecasts 2022

New York Property Tax Calculator 2020 Empire Center For Public Policy

Delaware Property Tax Calculator Smartasset

New Jersey Real Estate Market Prices Trends Forecasts 2022

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation